As most of us are fortunate enough, we have been living with our parents for all our lives. And so that means we have not had to be financially responsible for shelter. But as we grow up into adults, we will have to face the question – “where will we live?”

As we grow older into the second half of our 20’s – the conventional path is to start full-time work, to want more independence, maybe starting a family, and move out and get a place of your own.

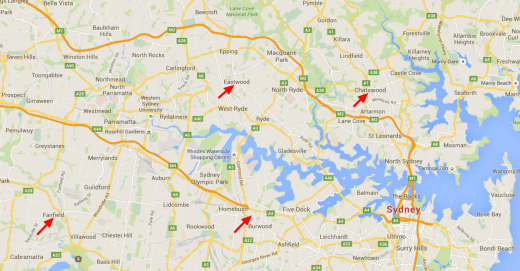

So what are the options, especially in the Sydney real estate market?

I did some basic calculations on the two options – buying and renting.

BUYING

The first option is buying. This seems to be the default long-term goal for most people. As Wikipedia says, “The Australian Dream is a belief that in Australia, home-ownership can lead to a better life and is an expression of success and security.”

But what do the numbers look like?

As of 2016, the median Sydney house price is $1,004,000. Wow.

For reference, I have always lived in Eastwood. The average 3 bedroom house is worth $1,520,000. The average 3 bedroom apartment is worth $1,030,000.

I did a quick search of some other suburbs.

Chatswood: 3 bed house – $1,775,000. 3 bed apartment – $1,346,500.

Strathfield: 3 bed house – $1,940,000. 3 bed apartment – $900,000.

Fairfield: 3 bed house – $707,500. 3 bed apartment – $500,000.

And here’s an article – the average piece of empty land in Kellyville is selling for $750,000, more than the median house price of Melbourne.

So how much would it cost to buy?

We can use some modest numbers and basic calculations. House price: $1,000,000. Let’s say you save up a put a $200,000 deposit upfront (20%). That means you have a $800,000 mortgage.

If you commit today to a 30 year loan, at current 4.5% interest rate, you will have to pay… $950 a week. For the next 30 years. That’s $50,000 a year.

With a $600,000 mortgage, that’s $700 a week. $36,000 a year.

Another important factor to remember – this is post tax income.

I think this catches many young people off guard, it certainly did for me when I first thought this through.

For example:

$60,000 salary is really $45,000 after-tax.

$70,000 becomes $50,000 after-tax.

$80,000 becomes $55,000 after-tax.

$90,000 becomes $60,000 after-tax.

And so on.. You can play with the pay calculator here.

As you can see, the average Sydney income-house price ratio is one of the most expensive in the world.

RENTING

The other option is renting. It seems more people are going this direction (perhaps by necessity), given the recent Sydney real estate boom.

What do the numbers look like?

The average Sydney house rent price is currently $530 a week ($27,000 a year) and average Sydney apartment rent price is $500 a week ($26,000 a year).

Similar to the previous examples:

Eastwood: 3 bed house – $630. 3 bed apartment – $635.

Chatswood: 3 bed house – $850. 3 bed apartment – $880.

Strathfield: 3 bed house – $640. 3 bed apartment – $650.

Fairfield: 3 bed house – $450. 3 bed apartment – $450.

And here’s an article – where data shows that average rent costs are taking up a more than a third of weekly income in Sydney.

So.. buying vs renting?

At this current time, I don’t have life experience in either. Buying seems better for the long-term if you intend to stay in the one place, but this requires a heavy upfront deposit and thoughtful commitment. Renting allows for more flexibility and less long-term commitment, but you don’t build any equity – is that sustainable plan for the rest of your life?

What does this all mean?

Ultimately, I think it is up your personal situation and how you interpret the numbers. It will mean different things to different people. It may be a wake-up call and push you start creating a long-term financial plan. It may lead you to some pessimism, and you may concede property ownership is beyond your reach. It may lead you to consider more creative housing solutions.

I think the starting point is to ask yourself – what is important to you?

One thought on “#4: On the cost of living in Sydney”

Comments are closed.